mortgage bonds meaning | mortgage calculator | mortgage deed | how to pronounce mortgage | mortgage translation | mortgage meaning latin | mortgage meaning in hindi | what is mortgage process

A mortgage is a loan used to purchase a real estate property in which the property serves as collateral for the loan. The borrower makes periodic payments to the lender, which typically include both the repayment of the loan’s principal and interest.

The term of a mortgage can last several years, usually 15 to 30, and the interest rate is typically fixed or adjustable. The borrower must have a good credit score and a stable income to be eligible for a mortgage. The lender may also require a down payment, which is a portion of the total purchase price of the property that the borrower pays upfront. The amount of the mortgage, down payment, interest rate, and repayment period will all affect the monthly mortgage payment the borrower is responsible for.

What Is a Mortgage

A mortgage is a loan agreement between a borrower and a lender where the borrower pledges their property as collateral in exchange for funds to purchase or maintain a home or real estate. The borrower repays the loan through regular payments that include both principal and interest, over a set term.

To be eligible for a mortgage, borrowers must undergo a thorough underwriting process, meet credit and income requirements, and may be required to make a down payment. There are various mortgage options available to meet the unique needs of each borrower, such as conventional loans and fixed-rate loans.

How Mortgages Work

A mortgage works by a lender providing funds to a borrower to purchase or maintain a home or other real estate. The property then serves as collateral for the loan. The borrower agrees to repay the loan through regular payments over a set term, which can range from 15 to 30 years. These payments typically include both the repayment of the loan’s principal and interest.

To be eligible for a mortgage, borrowers must undergo a rigorous underwriting process to assess their creditworthiness, income, and ability to repay the loan. The lender may also require a down payment, which is a portion of the total purchase price of the property that the borrower pays upfront.

The interest rate on the loan, the amount of the mortgage, the down payment, and the repayment term will all affect the monthly mortgage payment the borrower is responsible for. The lender holds the right to foreclose on the property if the borrower fails to make the payments according to the agreed terms.

Read this also:-

- Parivahan Application Status – Direct Link Driving License @vahan.parivahan.gov.in

- What Is the Password To Open ITR?

- Punjab National Bank NEFT RTGS IMPS – Charges & Timing

- What is NEFT in Banking Terms

The Mortgage Process

The mortgage process typically involves the following steps:

- Pre-approval: A borrower submits an application to a lender to determine how much they can afford to borrow and to get an estimate of their monthly mortgage payment.

- Property Search: The borrower begins to search for a suitable property within their approved budget.

- Loan application: Once the borrower has found a suitable property, they submit a loan application to the lender and provide documentation to support their income, assets, and credit history.

- Underwriting: The lender reviews the loan application and underwrites the loan to assess the borrower’s creditworthiness, income, and ability to repay the loan.

- Appraisal: The lender orders an appraisal of the property to determine its market value.

- Approval and Closing: If the loan is approved, the borrower and the lender sign a mortgage agreement and the closing process begins. The borrower pays the down payment and closing costs and receives the keys to the property.

- Repayment: The borrower makes regular payments to the lender, which include both the repayment of the loan’s principal and interest, over the agreed term of the loan.

The entire mortgage process can take several weeks to several months, depending on the lender’s requirements and the borrower’s ability to provide necessary documentation in a timely manner.

Types of Mortgages

There are several types of mortgages, including:

- Fixed-rate mortgage: The interest rate remains the same for the entire term of the loan.

- Adjustable-rate mortgage (ARM): The interest rate changes over time, usually in response to changes in a specified financial index.

- Conventional mortgage: A traditional mortgage that is not insured or guaranteed by the government.

- FHA (Federal Housing Administration) loan: A government-insured loan that allows borrowers with lower credit scores and income to qualify for a mortgage.

- VA (Department of Veterans Affairs) loan: A government-insured loan available to eligible veterans and active duty military members.

- USDA (United States Department of Agriculture) loan: A government-insured loan for low to moderate-income borrowers in rural areas.

- Jumbo loan: A mortgage that exceeds the conforming loan limit and requires a higher down payment and credit score.

Each type of mortgage has its own unique features and requirements. Borrowers should consider their financial situation, credit history, and the type of property they are purchasing when choosing the best type of mortgage for their needs.

Fixed-Rate Mortgages

A fixed-rate mortgage is a type of mortgage where the interest rate remains the same for the entire term of the loan, typically 15 to 30 years. Borrowers with a fixed-rate mortgage can budget their monthly expenses with certainty, as their monthly mortgage payment remains unchanged over the life of the loan.

Fixed-rate mortgages are a popular choice among borrowers who want stability and predictability in their monthly expenses. They are also a good option for borrowers who plan to keep their homes for a long time and want to avoid the risk of rising interest rates.

However, fixed-rate mortgages often have higher interest rates compared to adjustable-rate mortgages, and the monthly payments may be higher. Borrowers should consider their financial goals and the current interest rate environment when deciding if a fixed-rate mortgage is a right choice for them.

Adjustable-Rate Mortgage (ARM)

An Adjustable-Rate Mortgage (ARM) is a type of home loan in which the interest rate is periodically adjusted based on a benchmark index, typically the US Treasury Bill. ARMs offer lower initial interest rates than fixed-rate mortgages, but the rate can change over time based on market conditions. ARMs may be a good option for borrowers who expect to sell their home or refinance before the rate increases, or for those who are comfortable with taking on the risk of a changing interest rate.

Reverse Mortgages

A reverse mortgage is a type of loan that allows homeowners 62 years or older to access the equity in their home without having to sell it. The loan is paid out as a lump sum, a line of credit, or a series of payments, and it doesn’t have to be repaid until the borrower no longer uses the home as their primary residence or passes away.

Reverse mortgages can be an attractive option for seniors who want to access their home equity for expenses such as home repairs, medical bills, or living expenses, but they also come with significant risks and costs, including the possibility of outliving the loan and leaving a smaller estate for beneficiaries. It’s important to thoroughly research and understand the terms of a reverse mortgage before considering it as an option.

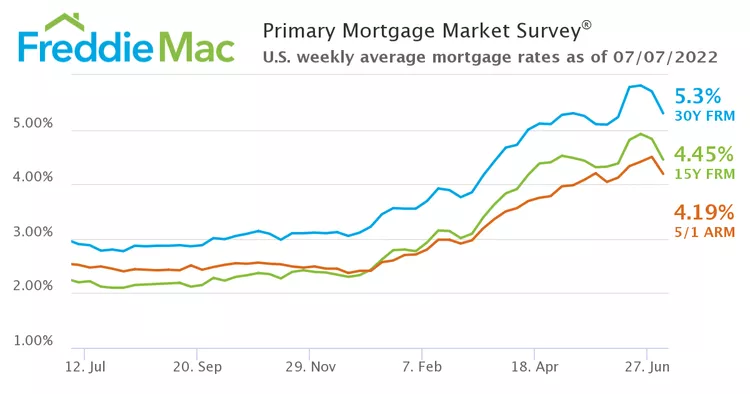

Average Mortgage Rates

The average mortgage rate varies based on several factors, including the type of loan, the lender, the borrower’s credit score, and the size of the down payment. As of January 30, 2023, the average interest rate for a 30-year fixed-rate mortgage was around 3.03%, while the average rate for a 15-year fixed-rate mortgage was around 2.36%. Adjustable-rate mortgages (ARMs) typically have lower initial interest rates, but the rate can change over time based on market conditions.

It’s important to shop around and compare rates from multiple lenders to find the best mortgage rate for your specific situation. Keep in mind that the average mortgage rate is just that, an average and your personal rate may be higher or lower based on your financial profile.

How to Compare Mortgages

When comparing mortgages, it’s important to consider the following factors:

- Interest rate: The interest rate determines your monthly payment and the overall cost of the loan. Compare the annual percentage rate (APR) of different mortgages to see the total cost of the loan, including fees.

- Loan type: Choose between fixed-rate and adjustable-rate mortgages (ARMs) based on your financial goals and risk tolerance.

- Loan term: The loan term affects both your monthly payment and the total cost of the loan. Shorter terms generally have lower interest rates, but higher monthly payments.

- Fees: Look at the origination fee, closing costs, and any other fees associated with each mortgage option to determine the total cost of the loan.

- Prepayment penalty: Some mortgages have a penalty for paying off the loan early, so make sure to consider this if you think you may sell or refinance your home in the future.

- Lender reputation: Research the lender and read reviews from other borrowers to ensure they have a good reputation and a history of fair lending practices.

It’s also a good idea to consult with a financial advisor or mortgage broker to help you compare and understand your options.

Why do We need mortgages?

Mortgages are a common way for people to finance the purchase of a home. Here are some reasons why people need mortgages:

- Affordability: For many people, the cost of purchasing a home outright is too high, and a mortgage allows them to spread the cost of the home over a longer period of time.

- Homeownership: A mortgage can help make homeownership possible, allowing people to build equity and create a long-term investment in real estate.

- Tax benefits: The interest paid on a mortgage is tax-deductible, providing a significant tax benefit to homeowners.

- Financial stability: By making monthly mortgage payments, people can establish long-term financial obligations and improve their credit scores.

- Forced savings: A mortgage payment can help people save money over time, as they are building equity in their home and creating a long-term investment.

Overall, mortgages provide a way for people to finance the purchase of a home and can help them achieve the goal of home ownership, build equity, and create long-term financial stability.

Can anybody get a mortgage?

Not everyone is eligible for a mortgage. To qualify for a mortgage, you generally need to meet certain criteria, such as:

- Income: You need to demonstrate a steady income and the ability to make your monthly mortgage payments.

- Credit score: Your credit score will be taken into account when determining your eligibility for a mortgage. Higher credit scores can result in better interest rates and loan terms.

- Down payment: Most lenders require a down payment, usually between 3-20% of the home’s value.

- Employment history: A stable job and employment history can increase your chances of being approved for a mortgage.

- Debt-to-income ratio: Lenders consider your debt-to-income ratio or the amount of debt you have compared to your income when determining your eligibility for a mortgage.

- Residency: Some lenders may require you to be a resident of the country or state in which you’re applying for a mortgage.

Ultimately, the specific requirements for a mortgage will vary depending on the lender, loan type, and financial profile. It’s important to research different options and speak with a financial advisor or mortgage broker to determine your eligibility for a mortgage.

What does fixed vs. variable mean on a mortgage?

In the context of a mortgage, “fixed” and “variable” refer to the interest rate of the loan.

A fixed-rate mortgage has an interest rate that remains the same for the life of the loan. This means your monthly payments will stay the same, even if market interest rates rise.

A variable-rate mortgage, on the other hand, has an interest rate that can change over time, often tied to an index such as the prime rate. This means your monthly payments can go up or down, depending on changes in the interest rate.

When deciding between a fixed and a variable-rate mortgage, consider your financial goals and risk tolerance. Fixed-rate mortgages offer stability and predictable payments but may have a higher interest rate compared to a variable-rate mortgage. Variable-rate mortgages can offer lower interest rates, but there is more uncertainty and the possibility of higher payments if interest rates rise. It’s important to weigh the potential risks and benefits of each option and consult with a financial advisor before making a decision.

How many mortgages can I have on my home?

In most cases, you can only have one mortgage on a single property at a time. Having multiple mortgages on the same property is called having a “second mortgage” or a “home equity loan.” This type of loan is secured by the equity in your home, which is the difference between the value of your home and the balance of your first mortgage.

In some cases, you may be able to have more than one mortgage on a property if you meet certain requirements, such as having a high credit score, sufficient income, and a large down payment. However, having multiple mortgages can increase your monthly payments and the overall cost of the loan, so it’s important to carefully consider the potential risks and benefits before taking out a second mortgage.

It’s also important to keep in mind that if you are unable to make your mortgage payments, your lender has the right to foreclose on your home and sell it to repay the loan. Having multiple mortgages on a property can increase the risk of foreclosure and may make it more difficult to keep your home in the event of financial difficulties.

Why did it call a mortgage?

The word “mortgage” is derived from the Old French word “mortgage,” which literally means “dead pledge.” This refers to the fact that a mortgage is a pledge of property as security for the repayment of a loan, and if the loan is not repaid, the lender has the right to foreclose on the property and take ownership.

The concept of a mortgage has been around for centuries and has been used as a way for people to finance the purchase of real estate and other assets. Today, mortgages are a common way for individuals and families to purchase a home and are a fundamental part of the modern financial system.

The Bottom Line

In conclusion, a mortgage is a type of loan used to finance the purchase of real estate, such as a home. The property is used as collateral, and if the loan is not repaid, the lender has the right to foreclose on the property. Mortgages can have either a fixed or a variable interest rate, and the terms and conditions of the loan will vary depending on the lender, type of mortgage, and the borrower’s financial profile.

When considering a mortgage, it’s important to carefully research your options and compare different lenders, interest rates, and loan terms. You should also consider factors such as your income, credit score, and down payment, as these can affect your eligibility for a mortgage and the terms of the loan. If you have any questions or concerns, it’s a good idea to consult with a financial advisor or mortgage professional to ensure you make an informed decision.

What Is a Mortgage

What Is a Mortgage FAQ

A mortgage is an agreement between you and a lender that gives the lender the right to take your property if you fail to repay the money you’ve borrowed plus interest. Mortgage loans are used to buy a home or to borrow money against the value of a home you already own. Seven things to look for in a mortgage.

A mortgage loan is a secured loan that allows you to avail funds by providing an immovable asset, such as a house or commercial property, as collateral to the lender. The lender keeps the asset until you repay the loan.

A home loan provides funding to help you upgrade, construct, or buy a residential property. Lenders consider the home or the property as collateral for the loan. Mortgage loans on the other hand are loans that are taken against a property collateral, i.e. loans against properties.

Mortgage refers to the process of offering something as a guarantee or collateral against a loan. One may come across the term when looking for secured loans. Generally, home loans of all types are secured loans. The borrower must offer their property as a security to the lender.