sbi zero balance account opening online | sbi new account opening | sbi online | sbi savings account opening online | sbi new account opening form | yono sbi account opening online | best bank to open account in india | online bank account opening with zero balance

The State Bank of India (SBI) is a multinational, public sector banking and financial services company based in India. It is a government-owned corporation with its headquarters in Mumbai, Maharashtra. The company is ranked 216th on the Fortune Global 500 list of the world’s biggest corporations as of 2020.

It is the largest bank in India by assets and by the number of branches, and it has a significant presence in overseas markets. SBI offers a wide range of banking and financial products and services, including personal and corporate banking, investment banking, wealth management, credit cards, and insurance. The bank also has a strong presence in the rural and agricultural sectors in India.

Open SBI Saving Account

An SBI saving account is a basic bank account offered by the State Bank of India that allows customers to deposit, withdraw, and transfer money as needed. An SBI saving account typically requires a low minimum balance, and it may offer a modest interest rate on deposits. The account may also come with a debit card or ATM card, which can be used to access cash at ATMs and make purchases at merchants that accept the card.

Some SBI saving accounts may have additional features or benefits, such as the ability to set up automatic payments or the option to link to a digital wallet. To open an SBI saving account, you will typically need to visit a branch of the bank and provide identification and other required documents.

Read this also:-

- Parivahan Application Status – Direct Link Driving License @vahan.parivahan.gov.in

- What Is the Password To Open ITR?

- Punjab National Bank NEFT RTGS IMPS – Charges & Timing

- What is NEFT in Banking Terms

SBI Savings Account Overview

An SBI saving account is a basic bank account offered by the State Bank of India (SBI) that allows customers to deposit, withdraw, and transfer money as needed. An SBI saving account typically requires a low minimum balance and may offer a modest interest rate on deposits. The account may also come with a debit card or ATM card, which can be used to access cash at ATMs and make purchases at merchants that accept the card.

Some features and benefits of an SBI saving account may include:

- Easy access to your money: You can withdraw cash at ATMs, make purchases using your debit card, and transfer money between accounts as needed.

- Interest on deposits: Depending on the specific account and prevailing interest rates, you may earn a modest amount of interest on your deposits.

- Link to a digital wallet: Some SBI saving accounts may be linked to a digital wallet, such as the SBI Buddy app, which allows you to make electronic payments and manage your account on the go.

- Automatic payments: You may be able to set up automatic payments for bills and other regular expenses from your SBI saving account.

To open an SBI saving account, you will typically need to visit a branch of the bank and provide identification and other required documents. You may also be required to make an initial deposit and maintain a minimum balance in the account to avoid fees.

Eligibility criteria for open SBI Saving Account

To open an SBI saving account, you must typically meet the following eligibility criteria:

- You must be a resident of India.

- You must be at least 18 years old.

- You must provide proof of identity (such as a government-issued ID or passport) and proof of address (such as a utility bill or bank statement).

- You may be required to make an initial deposit to open the account, and you may need to maintain a minimum balance in the account to avoid fees.

In addition to these general requirements, the eligibility criteria for a SBI saving account may vary depending on the type of account you are interested in and your circumstances. For example, some SBI saving accounts may have additional requirements or be restricted to certain groups of customers (such as students or senior citizens). It is a good idea to review the specific terms and conditions of the SBI saving account you are interested in before applying.

Minimum age to open SBI saving Account

To open an SBI saving account, you must be at least 18 years old. This is the minimum age requirement for opening a bank account in India.

If you are younger than 18, you may still be able to open a bank account in India, but you will typically need a parent or guardian to act as a co-signer or guardian on the account. Some banks may also have specific accounts or products designed for minors, which may have different eligibility requirements and features.

It is a good idea to review the specific terms and conditions of the SBI saving account you are interested in before applying, to make sure you meet all of the eligibility requirements. You may also want to consider consulting with a financial advisor or a representative of the bank to discuss your options and choose the account that is right for you.

Document Required for Open SBI Saving Account

To open an SBI saving account, you will typically need to provide the following documents:

- Proof of identity: A government-issued ID such as a passport, PAN card, or voter ID card.

- Proof of address: A utility bill, bank statement, or other official document showing your current address.

- Initial deposit: You may be required to make an initial deposit to open your SBI saving account. The amount of the deposit may vary depending on the specific account and your personal circumstances.

In addition to these documents, the bank may ask for other information or documents as needed to verify your identity and address and to assess your financial situation. It is a good idea to review the specific requirements for the SBI saving account you are interested in before applying and to bring all required documents with you when you visit the bank to open your account.

State bank of India Account Opening

To open a saving account with the State Bank of India (SBI), you can follow these steps:

- Visit an SBI branch near you.

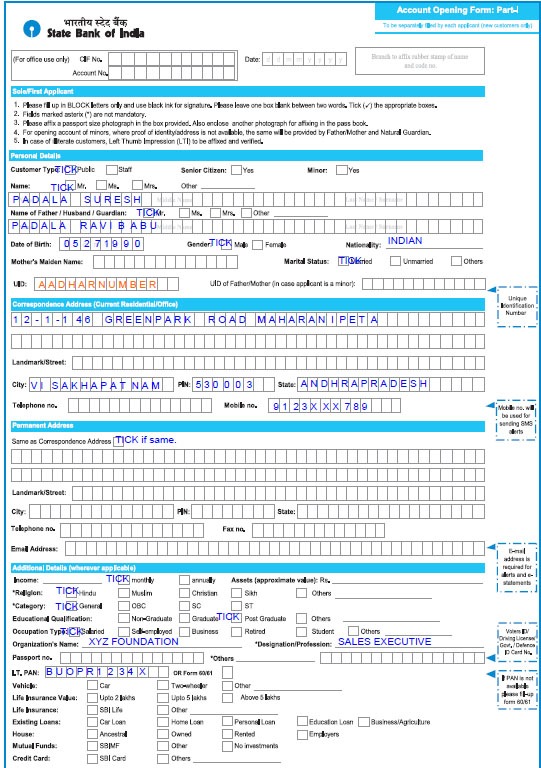

- Fill out the account opening form and submit it along with the necessary documents (ID proof, address proof, passport-size photos).

- Deposit the minimum balance required for the type of account you want to open.

- Provide your PAN and Aadhaar number for KYC purposes.

- Wait for the account to be activated, which may take a few days.

- You will receive a passbook and ATM card for your new account.

Note: The exact requirements and process may vary slightly based on your location and the type of account you want to open.

How to Open SBI Savings Account

You can open an SBI saving account by visiting a branch of the State Bank of India (SBI) and completing the necessary application process.

Apply for SBI Saving Account

To apply for an SBI saving account, you will need to visit a branch of the State Bank of India (SBI) and complete the necessary application process. Here are the general steps you can follow to apply for an SBI saving account:

- Gather the necessary documents: To apply for an SBI saving account, you will need to provide proof of identity (such as a government-issued ID or passport) and proof of address (such as a utility bill or bank statement). You may also need to make an initial deposit to open the account.

- Choose the right SBI saving account: SBI offers a range of saving accounts with different features and benefits. It is a good idea to review the options and choose the account that best fits your needs.

- Visit an SBI branch: You can find a list of SBI branches near you on the bank’s website or by using a search engine. Make sure to bring all of the necessary documents with you when you visit the branch.

- Complete the application process: A representative of the bank will help you complete the application process and apply for your SBI saving account. You may be asked to provide additional information or documents as needed, and you may need to sign some forms.

- Wait for approval: The bank will review your application and may ask for additional information or documents as needed. Once your application is approved, you will be able to open your SBI saving account.

It is a good idea to review the specific terms and conditions of the SBI saving account you are interested in before applying, to make sure you understand the requirements and any fees or charges that may apply.

Offline Way to Apply for State bank of India Savings Account

To apply for a State Bank of India (SBI) saving account offline, you will need to visit a branch of the bank and complete the necessary application process. Here are the general steps you can follow to apply for an SBI saving account offline.

SBI Account Opening Form

Open SBI Saving Account

Open SBI Saving Account FAQ’s

Interested individuals can open SBI digital savings account online without visiting branch by video KYC through contactless procedure. Paperless account opening and no branch visit needed. Only Aadhaar details & PAN(Physical) required. Customer will be able to transfer funds using NEFT, IMPS, UPI etc.

To activate the internet banking facility through an ATM card, choose the option “I have my ATM card (Online registration without branch visit). Click on Submit and you will have to enter the details of your ATM card like card number, expiry date, card holder’s name, and ATM PIN.

A SBI Basic Savings Account can be opened free of cost at any SBI branch. This account is KYC compliant and can be operated as a single account or jointly.